The “Mysterious” Second-Hand Semiconductor Equipment Market

Wu Shouzhe of JW Insights recently published an interview with me regarding my activity as a broker of used semiconductor equipment in their on-line journal, which is widely distributed in China.You can see the original article at the following link:-

https://www.ijiwei.com/n/897099

Here is an English transaction of the article, followed by a copy of the original article in Chinese:-

Jiwei Interview | Business Opportunities and Hidden Reefs: The “Mysterious” Second-Hand Semiconductor Equipment Market

Author: Wu Shouzhe 11th March 2024

Related public opinion

AI interpretation article

Source: Aijiwei #second-handequipment# #ExportControl# #ASML# #KLA#

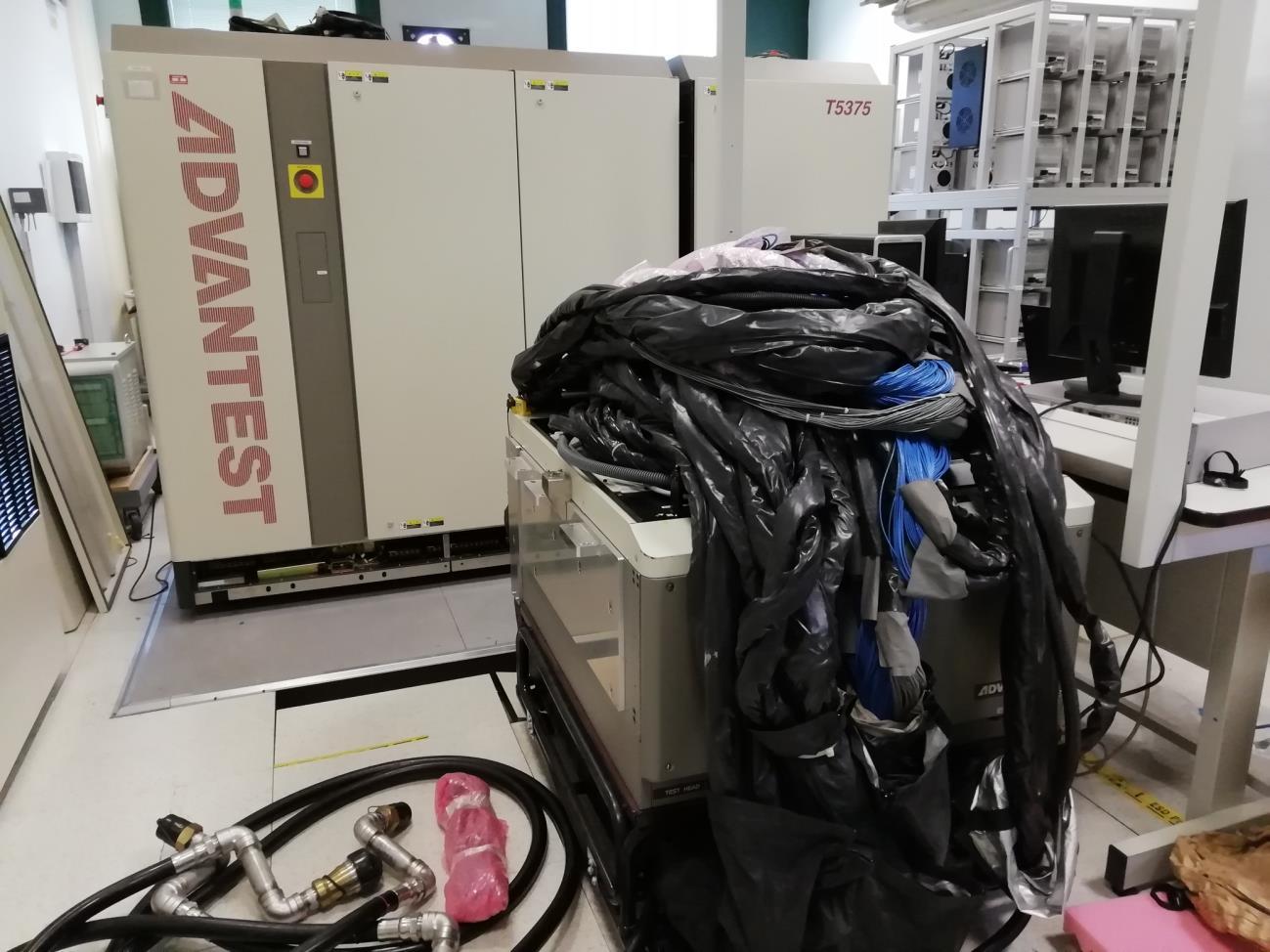

[Interviewee in this issue] Stephen Howe – founder of SDI Fabsurplus, one of the largest independent second-hand semiconductor equipment suppliers in Europe. A former KLA engineer, Stephen Howe has accumulated a rich experience and developed many connections in the field of second-hand semiconductor equipment since he founded SDI Fabsurplus in 1998, and has extensively served major Fab factories in Europe and Southeast Asia. Currently, SDI Fabsurplus has a huge second-hand semiconductor equipment sales network and buyer database , which have become a force that cannot be ignored in the semiconductor equipment industry.

Jiwei Interview: Hello Mr. Howe, I am very glad to have such an opportunity to discuss the situation of the second-hand semiconductor equipment market, an area that has not received much attention from the business world at large before. I recently received your company’s used equipment sales bulletin, which you send out via email. One point I note from the sales list is the “quality condition”, which is divided into different grades, such as “almost new”, “very good”, “good”, “poor”, etc. What are the quality standards of these second-hand semiconductor equipment, and what indicators is this evaluation system based on ?

Stephen Howe: There was a standard released a long time ago by an organization which was called SEC/N which was a Secondhand Semiconductor Equipment Sales Association, but then, that organization was absorbed into the US based SEMI organization, which also organises the conferences worldwide such as the upcoming SEMICON China exhibition in Shanghai.

The SEC/N organization had previously drawn up a list of parameters by which we could define the quality of used equipment. But at Fabsurplus.com , I don’t use these parameters, because I think the condition of used equipment is very much subject to personal opinion and difficult to quantify.

In fact, this is the reason why someone like myself, who has a very long experience of working with used equipment, has an significant advantage over people who are not professionals working in this sector. Also, if you are buying used equipment, it is very important to have that equipment inspected by an experienced engineer Becuase a good engineer will know the weak points regarding each piece of used equipment, as all the different equipment types have their own weak points, and hence engineers that are specialised in working on that equipment come to learn what the weak points are.

For example, if there is a circuit board on a piece of equipment that is not reliable, which is generally related to the design process, the engineer will be aware of that board and then they will be able to do diagnostic checks to find out if that board is OK or not. For example, they can check whether it is running properly or if it has had some modification done that eliminates that error.

Jiwei Interview: Yes, the evaluation of the quality of second-hand semiconductor equipment is often subjective. Every piece of equipment has its own life cycle.

Where do your company’s second-hand equipment come from? What are the purchase channels?

Stephen Howe: You said that equipment has a life cycle, but we still need to look specifically at what this life cycle is. Many specialized equipments are designed to perform only certain tasks and processes, and sometimes the equipment may actually have been purchased in error. It can happen also that the buyer purchases the correct equipment, but then, for some reason, the buyer decides not to start the intended process, or else the process changes at the last minute, or else they just got a new contract, so in the end they no longer need the originally purchased equipment.

So , in such cases, we can even find a pretty much new piece of equipment on the second-hand market which is just not needed becuase it has such a specialised functionality. However, generally speaking, most of the major companies use their equipment for about ten years, which is related to their financial models. They normally have a planned depreciation of the equipment over a 3 years period, then they plan to use it for at least 5 years in their production line to make sure to get a break even from a financial point of view and then I have observed that companies like the big memory chip makers, they’ll keep the tools in their production lines for about 10 years and after that they’ll try to retire them.

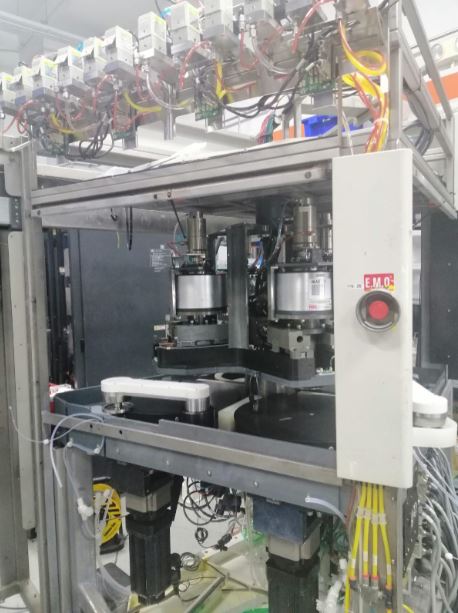

Jiwei Interview: In addition to selling equipment, do some of your customer services also include the assembly and maintenance of second-hand equipment?

Stephen Howe: It depends on the availability of engineers, that is, whether there are suitable engineers to support these services. Because this requires working with OEMs, it can be quite a challenge, and the OEMs don’t always give us good support. The OEMs have a range of different policies. Some of the OEMs are willing to work with used equipment dealers, whilst others don’t on a case-by-case basis. But we also have a network and connections of 3rd party engineers who either used to work for the OEMs and became independent or else otherwise learned how to work on the equipment by themselves, and they have different levels of skill in using the equipment.

Obviously, if I need support for installation services on some piece of equipment, I will reach out to our network of engineers.

Jiwei Interview: You just mentioned that large memory chip equipment manufacturers sometimes change their production line strategies. For example, Samsung changed its production line originally used for DRAM to CIS. Will these strategic adjustments also lead to some equipment flowing into the second-hand market?

Stephen Howe: Yeah, that’s right. The semiconductor equipment market is also very much a cyclical market. Based on past experience, there have been times when everyone is buying equipment in a big way, and then there are times when the market goes down and the excess equipment cannot be sold. In those times, when the market is down, everyone is trying to cut costs, and then they remove equipment from production. Therefore, a large amount of second-hand equipment accumulates that can be reused, and a lot of the equipment has been scrapped in the past. This is a huge waste of resources, because these pieces of equipment are very difficult to produce and very expensive to make in terms of the required environmental resources. I think it is a real shame to scrap equipment that could still be used.

But looking at the situation in recent years, I think the global equipment market has undergone some changes. Because previously, the majority of the fabs were using 200 mm or 8 inch wafer size equipment. So, in the past, we had a ready supply of equipment from factories of companies like Intel ,Micron Technology and Samsung who pulled out a lot of 8-inch equipment because the lines were outdated for their state-of-the-art processes. So it was easy for us to buy these pieces of equipment and then repurpose them for use in the Tier 2 Fab factories. These 2nd tier fabs use these second-hand tools to manufacture certain analog devices. Analog integrated circuits often do not require very advanced process nodes and such devices are also often produced using smaller wafer sizes.

But now that large manufacturers are using equipment for the manufacturer of the larger 12 inch wafers, it is a pity that the supply chain for a large number of obsolete 8-inch equipment is no longer there. Because of this, currently, 8-inch compatible tools are still in very short supply. In fact, some OEM equipment manufacturers, such as Applied Materials, recently announced that they will start manufacturing 8-inch equipment again, so this has been a radical change to the structure of the used equipment market.

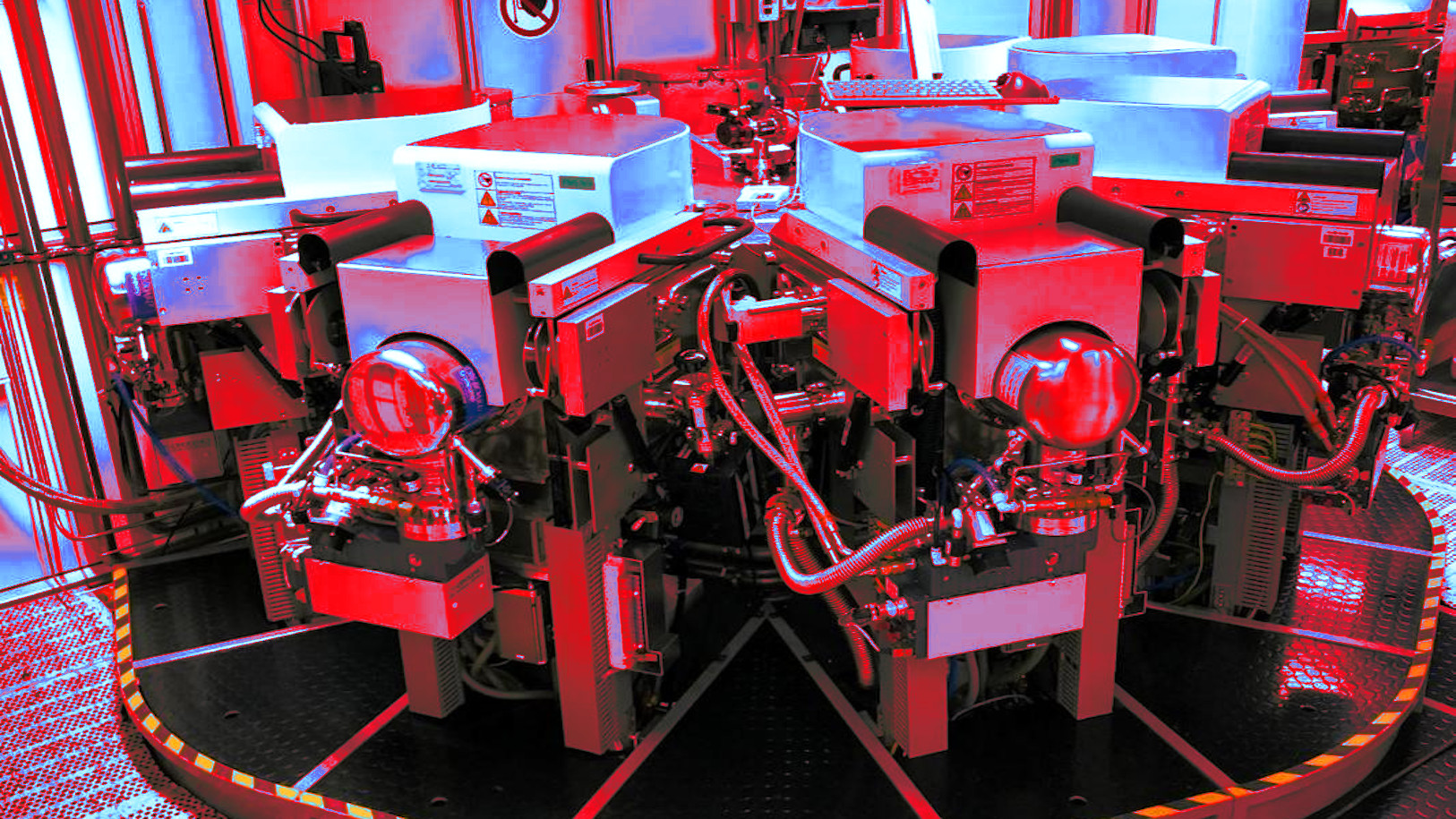

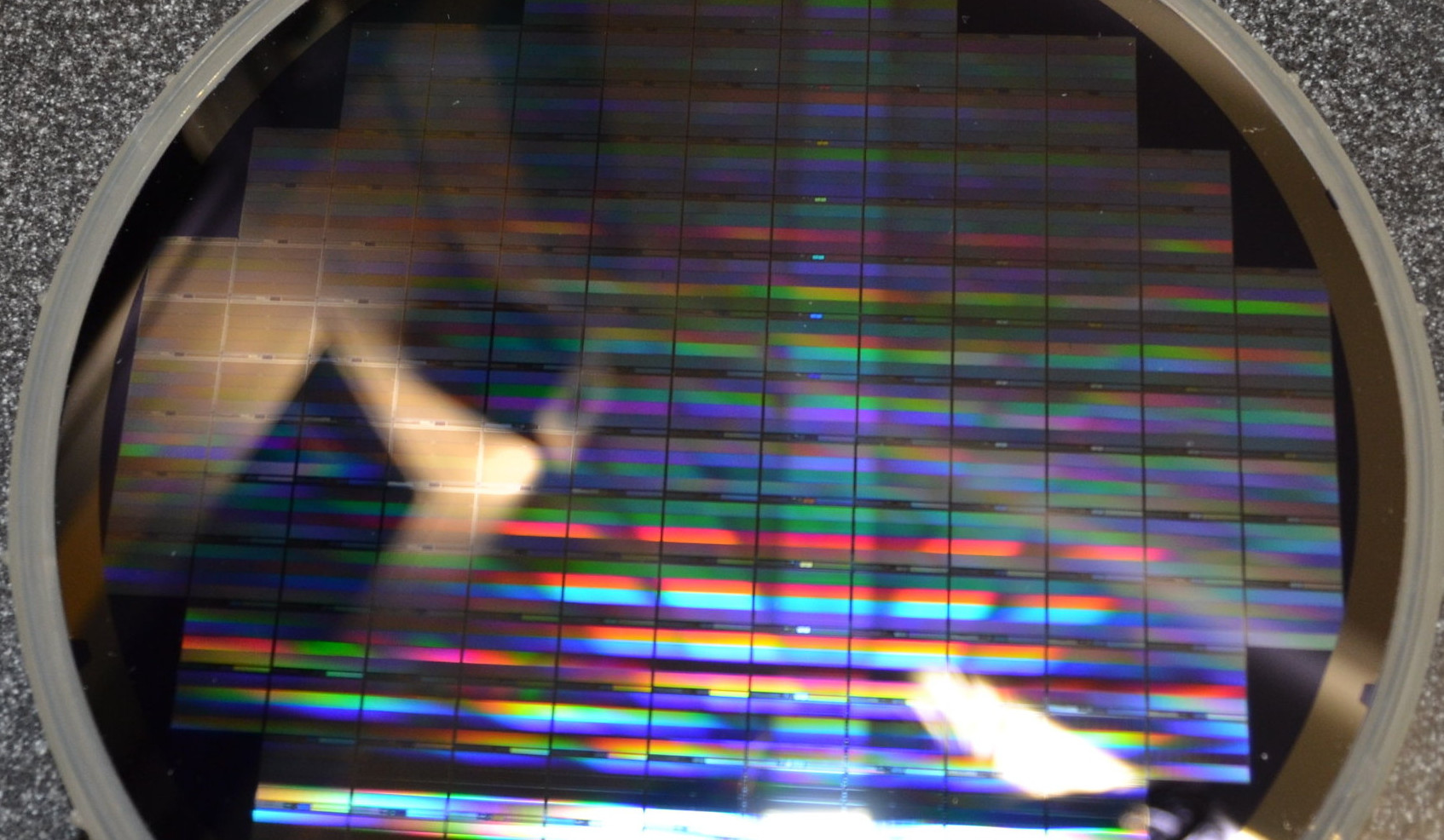

Jiwei Interview: Judging from the list of equipment you sent me, the uses and specific scenarios of these equipment are quite wide, involving front-end photolithography, etching, and ion implantation, as well as some back-end ATE equipment. Which of these devices has the highest profit margin? Is the profit margin of second-hand front-end equipment higher than that of back-end equipment?

Stephen Howe: As process nodes continue to advance, new equipment on the market is becoming more and more expensive. The most advanced of these equipments are used to operate at the smallest line widths, such as 5nm, 2nm, and other nodes below 10nm. Such equipment is becoming fantastically expensive.

For example, a single piece of lithography equipment for such nodes may cost more than 100 million U.S. dollars. And, it’s the same for the metrology equipment for these process nodes too. That is, the equipment they use to look at their production with, becuase they have to see what they are making . And so that equipment has also become fantastically expensive. So obviously, if you’re buying and selling a tool like that in the used market, the price is higher and hence your margin, which is normally a percentage of the overall cost, becomes larger. This is, of course, a very simplistic way of looking at it. We need to bear in mind that it is also very, very difficult to support these state-of-the-art machines, so you start to run into a series of huge costs which seriously cut into your profit margin. For example, most people will turn to the OEM for support in these cases. And the cost of the OEM work is very, very expensive.

Therefore, supposing you want to buy, for example, an ASML TWINSCAN XT:1900i lithography tool and you manage to source one from a second-hand equipment dealer, ASML will not necessarily be very happy about it, because they may prefer that you buy either new equipment from them or even a second-hand tool from them.

In fact, the current problem with such a scenario is finding the labor to be able to install the tool because currently, there is a big backlog on the availability of the specialised labor capable of working on tools like the ASML lithography systems.

Jiwei Interview: I previously talked with a senior leader of a second-hand equipment company headquartered in Asia. He told me that many original equipment manufacturers are now also developing second-hand equipment processing production lines, which is how to deal with their own internal equipment. Obsolete equipment is also a major source of profit. Will this form a competitive relationship with second-hand equipment manufacturers?

Stephen Howe: I don’t think so. The second-hand semiconductor market is very large. Everyone wants to control their own second-hand equipment. Is this possible? I can tell you that the first large original equipment manufacturer to enter the used equipment market was KLA, the one that did process control. They are currently very successful. I actually started studying semiconductor equipment at KLA. I was an equipment engineer at KLA in the 1990s. With my work experience at KLA, now I can become an excellent equipment engineer and enter the second-hand equipment market.

I think I was personally instrumental in getting KLA into the used equipment market. In 2005, I went to China to attend Semicon China. At the show, I went to the executive reception and accidentally met my former employer and the then company president Kenneth Levy.(Actually, I don’t recall if I met Ken Levy or Ken Schroeder). I explained my business model to him and I said, “Hey, we are selling used equipment made by your company and also I thank you so much for training me in your company and hence allowing me to have this opportunity.”

Not long after, I was contacted by a guy from KLA who said he wanted to start buying and selling used equipment. Then they set up a used equipment division and they were one of the first OEMs to get into this business. In fact, I myself have sometimes sold KLA’s obsolete equipment back to them, and we do sell some equipment to OEMs generally, although they don’t usually publicize this because we’re in competition. Again, regarding the risk of the second-hand market being controlled by OEMs, my answer is there is almost no risk because the market is too big to be controlled by them.

Jiwei Interview: You just mentioned the issue of 12-inch devices and 8-inch devices. The mainstream equipment in many product lines with mature technology is still 8 inches. According to some media reports, mainland China is currently increasing the production capacity of mature process chips, which requires a large number of 8-inch second-hand equipment. From your observation, is there any so-called “hoarding” of second-hand equipment by Chinese buyers?

Stephen Howe: Unfortunately, I don’t have much business dealings with mainland China. I really hope to have more business dealings with Chinese customers in the future, but currently,I have very few. I think this is mainly due to cultural issues.

So my company does not have very good market penetration in China. I think there are other companies in Asia Pacific that may be doing more business in China. Many years ago, maybe around 2005, I was doing more business in China. I haven’t done that much since then, mainly because my company is based in Italy and my clients are mostly in Europe.

Of course, the lucky or better thing for me is that I don’t need to go to China and other places further away to find more customers becuase there are many local customers who can support our business.

But I know Chinese buyers are buying a lot of equipment, and as far as what you said about 12-inch and 8-inch, in fact, the price of second-hand 8-inch equipment may not be cheaper than 12-inch any more. Because 12-inch equipment is more difficult to use,and this equipment is often used in the production lines of larger device manufacturers. Also, if you want to produce 8 inch devices on 12-inch equipment, then the equipment may require some special reconfiguration.

There are also problems such as chemical overspray during equipment operation. Spraying in wet chemicals that were intended for a 12-inch wafer and using them on an 8-inch wafer creates a lot of waste. So for those reasons combined, a used 12-inch machine might actually be a lot cheaper than a used 8-inch machine because these big companies are not making 8 inch wafers any more and so the 8 inch configured equipment tend to be older and less easy to find, which makes them become more expensive.

The used equipment market has been in a state of explosive growth before. Right now, the market has been experiencing explosive growth from around 2016 to last year, but by the middle of last year, the growth had narrowed a lot. I think overall prices are coming down now as well. Prices for 12-inch devices are sure to drop, but 8-inch devices are in short supply. It’s hard to tell how much a given 8-inch device should cost because there aren’t many of them on the market.

Obviously, this is helping prices of used 8-inch machines stay high due to the shortage of supply. recently, I’ve even seen cases where some “copy” 8-inch machines were manufactured by third-party companies. They have copied a popular 8-inch machine platform. The whole tool is not made by the OEM, but it’s an exact replica, and in this case, we don’t know what the quality will be like.

Jiwei Interview: Do you have any plans to explore more global markets in the future, such as opening an office in China?

Stephen Howe: We currently have no offices in the United States and China. This is also due to the travel issues caused by the epidemic. Currently, our company has offices in the UK and Italy. In addition, we also cooperate with companies in Singapore, including some third-party engineering companies.

If there was an opportunity to set up in China, it would definitely be very interesting. However, I think the Chinese market is too complicated for Westerners like me and I think if you open an office in China, you need to find a suitable Chinese person, that is, let the Chinese person help you understand the Chinese way of doing business, understand the Chinese culture and the Chinese language. Unfortunately, I don’t speak Chinese at all, so I will need many Chinese local resources to assist me.

Jiwei Interview: Language barrier is indeed a problem. Currently, due to certain geopolitical factors, the United States has tightened its import and export controls on China. In terms of many equipment required to manufacture advanced chips, especially in the field of lithography equipment, Fab factories in mainland China have been prohibited from obtaining EUV and certain Some DUV equipment. Therefore, many semiconductor companies will face some compliance issues under the new situation. How do you help customers solve this problem?

Stephen Howe: To be honest, I’m not very involved in compliance activities. I have a lot of experience importing and exporting equipment, so I know what to do, so I usually don’t get too involved in the compliance side of things. I have my own personal opinion on the whole issue of export restrictions. Regarding import and export control issues, when we are dealing with these relatively advanced second-hand equipment or equipment for certain special applications, we will need to pay close attention to any restrictions on sales locations.

All in all, there are always questions about export licenses that come up, and we do need to apply for an export license, just like any other additional paperwork that needs to be completed. However, if you look at the number of export licenses that are granted, such as those required to sell equipment into mainland China, in most cases even 90% of applications are successful.

The premise is to prepare enough paperwork necessary for import and export. If the preparations are done well, then the chance of successfully obtaining the license is very high. Then, there are also differences in import and export rules between Europe and the United States. I’m in Europe, so I deal with the European rules, whereas the United States has a different set of rules, and I don’t deal with the US rules any more becuase my company is in Europe.

In any case, China has a very good innovation environment and awareness in the field of integrated circuits, and your engineers have been making good progress. Frankly speaking, I think that in an environment facing heavy sanctions, China’s strategy should be to slowly break through from older technology nodes and then move towards advanced process nodes. I am sure that China will achive this; I am very confident about it.

Jiwei Interview: However, due to import and export control issues and the establishment of a series of “blacklists” by various US departments, more and more overseas equipment manufacturers are becoming more and more cautious when doing business with China.

Stephen Howe: Yes, and , of course my company will also be very cautious during this time when it comes to doing business with China because, especially for the used equipment market, we typically don’t deal with end users, we typically deal with brokers.

So the problem is with brokers, you can never know 100% where they’re going to re-sell the equipment. The last thing we want is for a tool to end up in a banned country, which is also a bad thing for us. So we handle this situation very carefully and we don’t want this to happen.

Jiwei Interview: You just mentioned that Applied Materials is producing new “old equipment”, and it seems that they are not the only one doing this. According to Japanese media reports, Nikon wants to develop i-line lithography equipment of the 1990s, which it calls a “special product for supply to China.” They see a lucrative business opportunity. Will this affect your company’s business?

Stephen Howe: Maybe if they were to launch a “new product” that competed with the used products, then obviously that would take market share away from us.

But again, as I said before, the market is so vast and the amount of used equipment is so huge that no one OEM can control this market. It’s just a market that is free, and these used tools are coming up for sale all the time. Often, OEMs will offer to buy back used equipment from the owners of those units, but they only offer a very, very low price.

So, as brokers, we can reach out to offer owners of used equipment better prices and better value for their used tools, and so I think we are in a good position to be able to compete well with the OEMs.

Even if OEMs start re-manufacturing second-hand products, I still think we are capable of competing with OEMs because the prices of the OEM refurbished second-hand products are always much higher than our prices. With independent brokers of used equipment like us, we can sometimes find tools which are still being used in the factory of our supplier , and they don’t need the tool any more, the tool is in running condition, you can go and see it operating in the facvory, you can check out it is working OK, and then all you need to do is pay for an engineer to remove it and then do the shipping to where ever it is going, and then re-install it again. And so, in this case, the price can be very competitive.

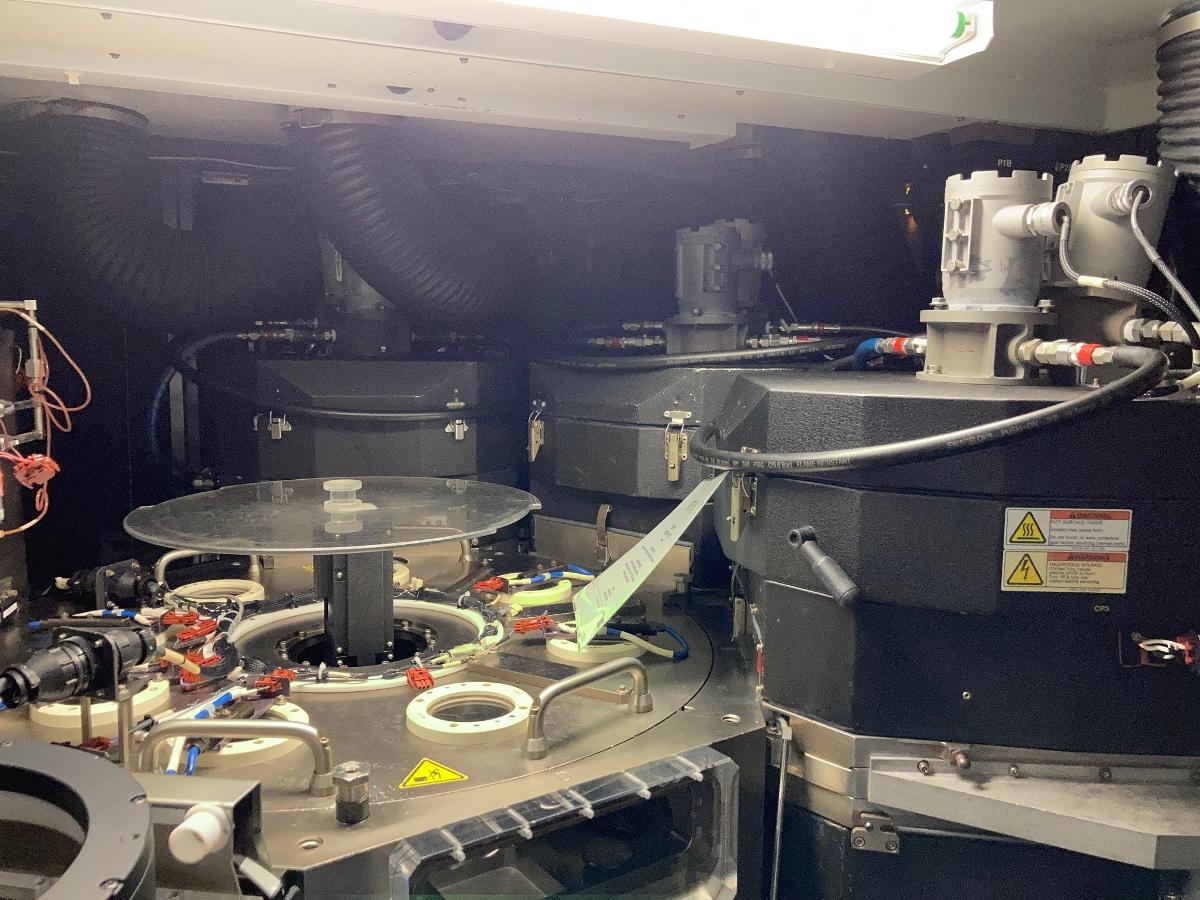

However this is an ideal scenario. Because when these tools are no longer needed, there is only a very short window of opportunity to be able to see the tool in running condition in the cleanroom, because they are fantastically expensive to keep running in the clean room . The clean room space is very expensive and the technicians time costs a lot just to keep the tool in running condition. Hence, you only have a very short window of opportunity and that is why the role of a broker can be very important. Becuase were are in contact with all these people, we are in contact with all these fabs, we find out where these tools are, and if somebody asks us for that tool we say “Yes, it’s available, we need to move now.” And then we take advantage of that window of opportunity to save a lot of money and also, don’t forget, we are also saving the environment, becuase these pieces of equipment are being re-used, instead of being thrown into the scrapyard, which would be a great waste of our resources, which are becoming more and more scarce.

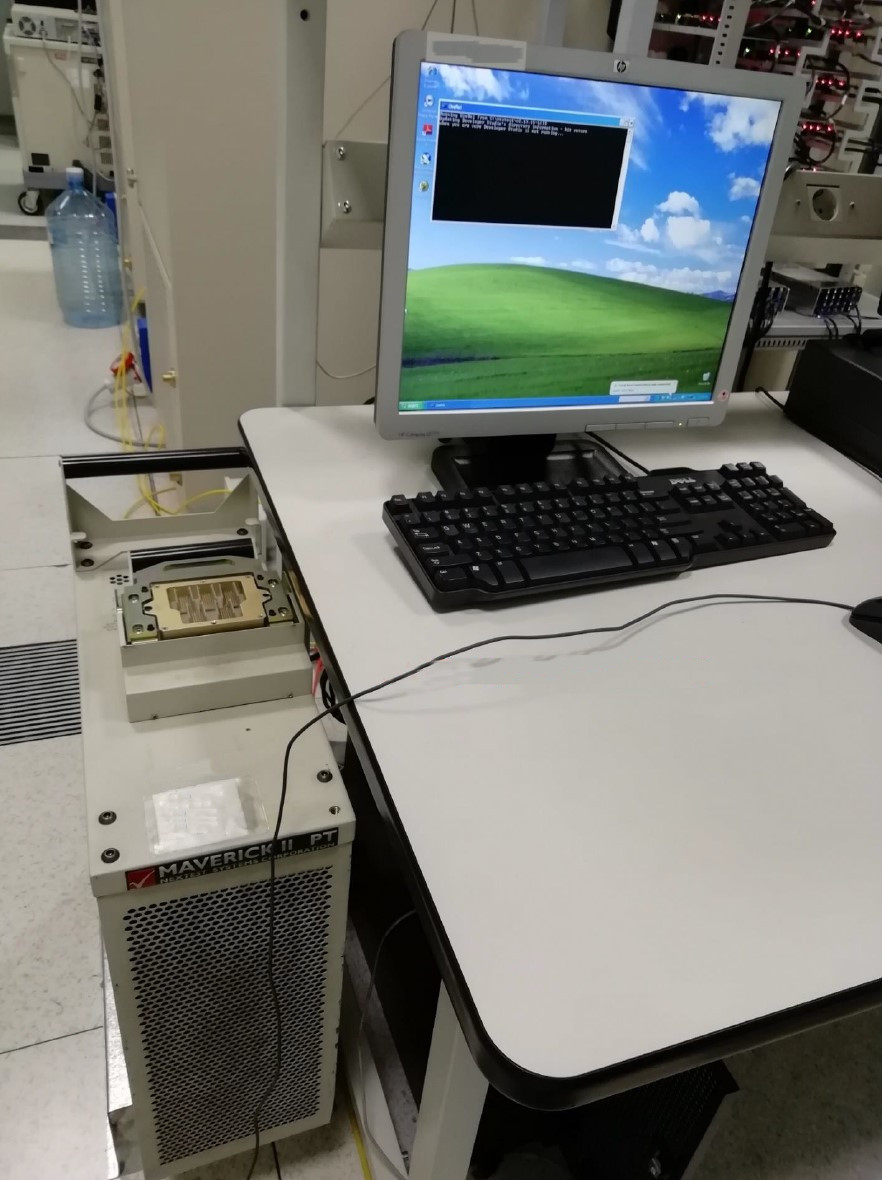

Jiwei Interview: Many semiconductor equipment need to be equipped with a lot of software, such as EDA tools. When you sell the equipment, do you also package the software for sale?

Stephen Howe: The issue you mentioned can be said to be a super delicate and even somewhat sensitive issue for us.

The European Union is currently formulating certain regulations to help improve the resue of equipment to help save the environment. According to these regulations, let’s say you have an old machine, then the equipment manufacturer should give you the software for it. However, it has been the case in the past that the machine manufacturer will not give third parties like us the software. So far, in the United States, there has been a case in the past regarding the availability of spare parts and also possibly software that can be studied as a precedent.

In that case, a group of second-hand equipment suppliers filed a lawsuit against a major OEM. They actually won the lawsuit and settled out of court to collect some compensation fees in exchange for not continuing the lawsuit. So, when I go to some OEMs to request software, they should not refuse to sell me it, but some of them do currently refuse, although, of course, I can’t tell you any of their names. Notwithstanding this, we hope that organizations like the European Union will pursue and implement this kind of legislation to help us re-use equipment and hence promote the saving of resources and the environment.

I think in China, the legislature should do the same thing. Although I don’t know what the situation is like in China, however we want to be able to re-use equipment. So we need to access to the software . Obviously, it’s irresponsible to use the software without a software license. So we always tell our customers that they should have a software license, and we recommend that they get it for their used equipment.

Jiwei Interview: Some customers do sometimes use pirated software due to various complex reasons.

Stephen Howe: Obviously I don’t recommend that. Also, it’s possible in some cases that some organizations can reverse engineer or used third-party software packages on their equipment. That is another possibility and personally, I don’t see any problem with that if you can make your own alternative software package . In fact, I once even saw a second-hand semiconductor equipment software package running on a machine in a factory in China which they had written themselves.

Jiwei Interview: Regarding software licensing issues for second-hand devices, Europe and the United States do seem to have some differences in laws and regulations.

Stephen Howe: I think the EU is currently trying to legislate. According to their previous statements, one of their priorities is working to protect the environment. And I think China has also made a lot of efforts to protect the environment. So we hope they’re serious and they can help give us more legislation to ensure that supply chains can reuse equipment, because it’s not necessarily going against what the OEMs best interests are.

For example we can look at ASML. They are very successful in handling used equipment and they have a dedicated used equipment division. This division runs very efficiently within their company and they do support their old products, probably a lot better than a lot of the other OEMs. Therefore, it is not necessarily in best interests of these OEMs for them to place restrictions on the use of software for their used equipment.

Jiwei Interview: Currently, many of the world’s leading consulting organizations regularly publish global and regional semiconductor equipment market conditions. I suspect that the data they released does not actually include the second-hand semiconductor market. Is this market still relatively opaque and fragmented in terms of data collection and various information disclosures?

Stephen Howe: Yes, exactly. I totally agree with you. Statistics on the second-hand semiconductor equipment market are very difficult to calculate. You could say it is a “secret market” and it is still very fragmented, which makes this market very interesting.

Jiwei Interview: Thank you for taking the time to be interviewed by us.

https://www.ijiwei.com/n/897099

集微访谈 | 商机与暗礁:“神秘”的二手半导体设备市场

作者: 武守哲 03-11 17:43

相关舆情

AI解读

生成海报

来源:爱集微 #二手设备# #出口管制# #ASML# #KLA#

32.6w

【本期受访人】Stephen Howe——欧洲最大的二手半导体设备商之一的SDI Fabsurplus创始人。前KLA资深工程师,自1998年创办SDI Fabsurplus以来,Stephen Howe在二手半导体设备领域积累了丰富的经验和人脉,广泛服务于欧洲和东南亚的各大Fab厂,目前SDI Fabsurplus拥有一个庞大的二手半导体设备销售网络和买家数据库,成为了半导体设备行业一股不可忽视的力量。

集微访谈:Howe先生您好,很高兴有这样一个机会,探讨一下二手半导体设备市场——这个之前不太为外界所关注的领域的一些状况。我阅读了您邮件发来的公司货物清单,其中有一项是“质量状况”,分成了“几乎全新”、“很好”、“好”、“差”等不同等级,对这些二手半导体设备的质量,这个评价体系是根据什么指标建立的?

Stephen Howe:这个标准的设定,是很久以前有一个类似名叫“二手半导体设备销售协会”的组织搞的,但是后来这个组织被吸收到了SEMI中,他们马上要在中国组织SEMICON China展会。

这个组织之前拟定了一个参数列表,外界可以通过这些参数来定义二手设备的质量状况。但就我个人而言,我不使用这些参数,因为我认为二手设备的状况非常受个人意见的影响,是很主观的,也很难量化。

事实上,这就是为什么像我这样拥有丰富二手设备操作经验的人,比其他人更适合建立设备质量评价标准。用户在使用二手设备方面可能没有那么丰富的经验,而且如果你要购买二手设备,有一点非常重要,就是需要经验丰富的工程师来检查设备,工程师们知道每台二手设备的弱点和欠缺点,所有不同的设备都有自己的某些欠缺点,熟练操作该设备的工程师很清楚设备的不完美之处。

例如,某台设备上有一块不太好的电路板,它可能与设计流程有关,工程师将了解该电路板的运行情况,他们能检查它是否正常运行,或者进行一些针对性调试,以消除这些问题。

集微访谈:是的,对二手半导体设备质量的评估往往是比较主观的。每台设备都有属于它的生命周期,请问贵司的二手设备都来自什么地方?进货渠道是什么?

Stephen Howe:你说设备是有生命周期的,但还是要具体看这个生命周期是什么。很多专用的设备是用来完成某些特定任务和流程的,所以有时候这些设备实际上可能是被错误购买了。业界都认为买家知道如何使用新设备,但后来由于某种原因,买家决定不启动那个原定的流程。流程在最后一刻改变了,或者他们刚拿了一份新合同,所以他们不再需要原来的设备了。

所以有时候我们甚至可以在二手市场上找到一个相当新的设备,这是因为原来的买家突然因为各种原因不需要了,该设备具有非常特殊的功用,可以处理某些特定流程的专业功能。但一般来说,大多数公司使用设备的周期约有十年左右,这与他们财务状况有关。他们通常会对设备进行3年的工厂折旧,并且计划在生产线上使用至少5年,以便从财务角度实现收支平衡。

像大型存储芯片制造商这样的公司,他们会将某些设备保留在生产线中大约10年,然后他们会尝试将其淘汰掉。

集微访谈:除了卖设备之外,你们的一些客户服务是不是也包括二手设备组装和维护?

Stephen Howe:这取决于工程师的可用性,就是说有没有合适的工程师来支持这些服务。因为这需要与原始设备制造商合作,和这些人合作可以说相当困难,他们并不总是给我们很好的支持。我有一系列不同的针对性政策。原始设备制造商的工程师其中一些愿意与二手设备经销商合作,而其他选择不和经销商合作,视具体情况而定。但是,我们还有一个工程师网络和人脉,他们要么曾经为原始设备制造商工作,后来变得独立了,要么学会了如何操作设备,他们有不同级别的设备使用技能。

显然,如果我需要获得某些设备项目的安装服务支持,我可以联系我们工程师人脉圈。

集微访谈:您刚才提到了大型的存储芯片设备商,有时他们会改变一些产线策略,比如三星,原本用于做DRAM的产线改成做CIS,这些策略调整是不是也会导致某些设备流入二手市场?

Stephen Howe:对,没错。半导体设备市场也是一个周期性的市场。根据过往的经验来看,所以有时买家在大肆购买设备,然后有时又市场下跌,过剩的设备又卖不掉了,大家都在努力削减成本,有一些厂商在不断拆除设备。所以说,有大量的二手设备可以被重新启用,其中不少能用的设备实际上被申请报废了,这是对资源的极大浪费,因为这些设备生产起来非常困难,对环境资源也造成了很不好的影响。

本来还能用的设备,把它们报废掉就真是太遗憾了。但看最近这些年的情况,我认为全球设备市场已经发生了一些变化。以前半导体新设备市场因为大部分可能他们使用的是8英寸晶圆的设备,我们的设备库里就有不少英特尔,美光科技的8英寸设备。

三星也撤下了不少8英寸设备,因为这些设备对于他们最先进的工艺来说已经过时了。所以我们很容易去购买这些设备,然后把这些设备卖给Tier2的Fab厂,这些Fab厂可以用这些二手设备制造某些模拟器件。模拟集成电路往往不需要很先进的工艺节点,也往往使用较小的晶圆尺寸的设备生产。

但现在随着大型制造商用了12英寸的主流设备,所以很遗憾的是,原来大量被淘汰的8英寸设备的这个供应链已经没有了。8英寸的可兼容设备的供应仍然相当短缺,目前情况仍然如此。事实上,一些OEM设备厂商,比如应用材料,最近宣布他们将重新开始制造8英寸设备,所以这对二手设备市场的结构来说是一个根本性的变化。

集微访谈:从您发给我的设备清单来看,这些设备的用途和具体场景还是很广泛的,涉及到前端的光刻、刻蚀,离子注入,还包括了后道的一些ATE设备,这些设备,哪些利润率最高?是不是二手的前道设备利润率也高于后道设备?

Stephen Howe:随着工艺节点的不断推进,现在市场上的新设备也越来越贵,这些设备用于以最小的线宽、纳米数运行,比如5nm,2nm,10nm以下节点上的先进设备是极其昂贵的。

一件新的光刻设备售价就高达1亿多美元,量检测设备和光刻设备一样,是用来检测过程控制的,也是非常昂贵的。所以很明显,如果你在公开的美国市场那里买卖新设备,交易的价格相比二手设备更高,你的利润会被这些设备成本吞掉很多。这是一种简单的观察这个市场的计算方式。维护和支持这些最先进的设备是非常非常困难的。

因此,如果你想买一台AMSL TWINSCANXT:1900i设备,从二手设备商这里找到了,ASML不一定会对此感到非常高兴,因为他们可能更愿意你从他们那里购买新设备甚至二手的。

目前的问题是,找到合适的专业工程师,能把市场上大量积压下来的二手设备运转起来是很关键的,他们的能力要和ASML一手产线工程师的水平差不多才行。

集微访谈:我之前和某个总部在亚洲的二手设备企业的高层领导聊过,他告诉我,现在不少原始设备制造商也在搞二手设备的处理产线,就是如何处理掉自己内部被淘汰的设备,也是一大利润来源,这是否会和二手设备商形成了竞争关系?

Stephen Howe:我不这么认为。二手半导体市场是非常大的,大家都想控制自家的二手设备,这可能吗?我可以告诉你,首家进入二手设备市场的大型原始设备商是KLA,就是做过程控制的那家。他们目前做得很成功,我实际上就是从KLA开始研究半导体设备的,在上世纪90年代我曾是KLA的设备工程师。凭借我在KLA的工作经验,所以现在我可以成为一名优秀的设备工程师,进入到二手设备市场。

我认为我个人促成了让KLA进入二手设备市场。2005年的时候,我去了中国参加了 Semicon China,在现场我去了KLA的行政接待处,并且偶然遇到了前东家,见到了当时的公司总裁Kenneth Levy 。我向他解释了我的商业模式,我说:“嘿,我们正在出售贵公司的这些二手设备,非常感谢您在公司对我的培训。”

不久之后,KLA的一个人联系我,他说他想开始买卖二手设备。然后他们成立了二手设备部门,他们是最早从事这项业务的OEM之一。事实上,我自己确实向他们出售了相当多的KLA被淘汰的设备,我们确实会向OEM厂商出售一些设备。他们通常不对外宣传这一点,因为我们处于竞争关系。再强调一遍,关于二手市场是不是有可能被原始设备制造商控制的风险,对此我的回答是几乎没有风险,因为市场太大了,大到无法被他们控制。

集微访谈:您刚才提到了12英寸设备和8英寸的问题。不少成熟工艺的产品线的主流设备还是8英寸。根据一些媒体的报道,目前中国大陆正在加大成熟制程芯片产能,需要大量的8英寸二手设备,从您的观察来看,有没有出现所谓的中国买家“囤货”二手设备的情况?

Stephen Howe:非常遗憾的是,我与中国大陆没有太多生意往来。我很希望能和中国的客户多一些生意上的往来,但确实很少,我认为这主要是由于文化问题。

所以我的公司在中国并没有很好的市场渗透率。我认为亚太地区还有其他公司可能会在中国开展更多业务。很多年前,也许是2005年左右,当时我在中国做了很多生意。从那以后我就没有做那么多了,这主要是因为我的公司总部在意大利,客户大部分都在欧洲。

当然,这对我来说幸运或者说比较好的一点是,我不需要去中国等更远的地方寻找更多客户,在本地就有不少客户能支持我们的业务。

但我知道中国买家正在购买很多设备,但就你所说的12英寸和8英寸的问题,实际上现在8英寸的二手设备价格可能不会比12英寸更便宜。因为12英寸的设备更不容易使用,这些设备往往用在更大型工厂的产线上,显然,你如果需要在12英寸设备上产出8英寸所需的哪些器件,这些设备可能需要一些特殊的调试。

在设备运行过程中还有化学品导入等问题。把原本用于12英寸的设备上的湿化学品,用在8英寸上,会造成很多浪费。因此,综合这些原因,二手12英寸设备实际上可能比二手8英寸设备要便宜得多,因为这些大公司正在淘汰8英寸设备,而8英寸设备往往比较旧,而且不太容易找到,这使得它反而变得更贵。

二手设备市场之前曾处于爆发状态,很火。该市场从2016年左右到去年,一直处于爆发式增长状态,但到了去年年中,涨幅已经收窄了很多。我认为现在总体价格也在下降。12英寸设备价格肯定会下降,但8英寸却供不应求。很难判断某款8英寸设备的价格应该是多少,因为市场上的数量并不多。

很明显,由于供应短缺,这有助于二手8英寸设备的价格保持高位。我甚至看到过一些案例,一些仿制的8英寸设备是由第三方公司制造的。他们会拷贝一个市面上很火的8英寸设备。它不是由原始设备制造商制造的,它完全就是一个复制品,在这种情况下,我们不知道质量会是什么样。

集微访谈:未来您有没有计划开拓更多的全球市场,比如说在中国开设办事处?

Stephen Howe:我们目前在美国和中国都没有办事处,这也是因为要应对因疫情造成的旅行问题。目前,我们公司在英国和意大利各设有办公室。除此之外,我们和新加坡的公司也有合作,也包括了一些第三方的工程公司。

如果有机会在中国设点,那肯定会非常有趣。因为我认为中国市场对于像我这样的西方人来说太复杂了。我认为如果在中国开设一间办公室,就需要找到一个合适的中国人,即让中方的人来帮助你了解中国人做生意的方式,了解中国文化以及中文,我根本不会说中文,我需要很多中国本土资源来辅助我。

集微访谈:语言障碍确实是个问题。目前,因为某些地缘政治因素,美国收紧了对华进出口管制规则,在很多需要制造先进芯片的设备方面,尤其是在光刻设备领域,中国大陆的Fab厂已经被禁止获取EUV和某些DUV设备。所以很多半导体企业因此会面临着一些新形势下的合规性问题,您是怎么帮助客户去解决这个问题的?

Stephen Howe:说实话,我不怎么参与合规活动。我在进出口设备方面有着丰富的经验,所以我知道该怎么做,所以我通常不会过多参与合规方面的工作。我对整个出口限制问题的看法有我个人的意见。在进出口管制问题上,我们正在处理这些比较先进的二手设备或者某些特殊应用的设备时,会关注一些销售地点的限制问题。

总而言之,总是有一些关于出口许可证的问题会出现,我们确实也需要申请出口许可证,这就和其它需要完成的额外文书工作程序是一样的。事实上,如果你看一下所授予的出口许可证的数量,例如将设备卖到中国大陆所需的许可证,在大多数情况下,甚至90%的申请都是成功的。

前提是做好进出口所必须的足够的文书工作,如果准备工作做得好,那么成功拿到许可证的机会就很大。欧洲和美国的进出口规则也存在差异。我目前主要面临的是如何处理欧洲的进出口规则,而美国则有不同的规则意识。

中国在集成电路领域有着非常好的创新环境和创新意识,你们的工程师一直在进步。坦白说,我认为,在面临重重制裁的大环境下,中国的策略应该是从较旧的技术节点开始慢慢突破,然后朝着先进工艺节点进发。我相信中国能够解决这个问题,我对此非常有信心。

集微访谈:但是因为进出口管制的问题,以及美国各部门制定了一系列“黑名单”,越来越多的海外设备商和中国做生意的时候也越来越谨慎。

Stephen Howe:是的,这段时间,我的公司在涉及到和中国的业务时也会非常谨慎,因为特别是对于二手设备市场,我们通常不与最终用户打交道,而通常与经纪人打交道。

所以问题在于经纪人,你永远不知道他们是否会流失。我们最不想看到的就是该设备被列入了对某国的禁用名单上,这对我们来说也是一件坏事。所以我们对这种情况的处理非常谨慎,我们不希望这种情况发生。

集微访谈:您刚才提到应用材料在生产新的“旧设备”,目前这么做的貌似也不止他们一家。据日本媒体报道,尼康要开发90年代的那种i线的光刻设备,号称“对华特供版”,他们看到了有利可图的商机,这会不会影响贵公司的业务?

Stephen Howe:也许如果他们要推出一种与旧设备竞争的“新设备”,那么显然这会挤占我们的市场份额。

但同样,正如我之前所说,市场变化如此之快,二手设备数量如此巨大,没有哪一家OEM可以控制这个市场。这是个公开的、开放的市场,这些二手设备一直在出售。通常,原始设备制造商会提出将二手设备回购给这些设备的所有者,但他们只给出非常非常低的价格。

因此,我们可以联系经纪人,为二手设备的所有者提供更好的价格和更高的价值,我们可以做得比那些OEM还要好。

即使OEM开始生产二手产品,但我依然认为我们有能力与OEM厂商竞争,因为OEM翻新的二手产品的价格总是比我们的价格高得多。有了我们这样的二手设备独立经纪人,我们可以针对某些客户进行定制化的产线服务,他们不再需要某些OEM厂商的服务。通过我们公司的服务,客户可以直接看到设备的运行状况,即可以直接去工厂看设备的质量,检查它的外观。客户所需要做的就是支付工程师费用,将其运送到目的地并重新安装。因此,在这种情况下,价格可能非常有竞争力。

当然了,我说的这是理想的情况。因为当某些Fab厂不再需要这些设备时,下游的买家只有很短的机会才能看到设备处于运行状态,因为它们在洁净室空间中保持运行,成本是非常昂贵的。这些技术人员仅仅为了保持设备的一切正常运行,这就需要花费很多时间和其他成本。

集微访谈:很多半导体设备要配上很多软件,比如EDA工具才能真正热启动,你们出售设备的时候,是不是连带着把软件也打包出售?

Stephen Howe:你提到的这个问题,可以说是一个超级微妙,对我们甚至是有些敏感的问题。

目前欧盟正在制定某些法规来帮助提升设备热启动的效率以促进环境保护。根据这些规定,比如说你有一台旧机器,那么设备制造商应该给你它附带的软件,但过去的情况是设备制造商不会向我们这种第三方提供此类服务,他们不会给我们软件。到目前为止,在美国,过去发生过一个很好的案例,可以作为判例来研究,我相信我也遇到过类似的问题。

这个案子就是,某二手设备商对一家主要的OEM提起了诉讼,他们实际上赢得了诉讼,以庭外和解收取一些赔偿费用的方式换取了不继续诉讼。所以这是OEM的问题。我去向一些OEM索要软件的时候,他们其中一些会直接拒绝。我不会向你告诉他们的任何名字,但他们很强硬,不会给你配套软件。但是我们特别希望欧盟针对此立法,他们会推行这个立法来帮助我们重复使用设备,促进资源环境的改善。

我认为在中国,立法机构应该做同样的事情。我不知道中国的情况如何,因为我们希望能够让二手设备得到重复使用。所以我们需要访问和启动该设备的软件,保证使用这些软件是合规的,如果没有软件许可证,用户则无法使用该设备。因此,我们总是告诉客户和业内人士,他们应该拥有软件许可证,我们建议他们为所使用的设备拿到软件许可证。

集微访谈:某些客户因为各种复杂的原因,确实有时候会使用盗版的软件。

Stephen Howe: 显然我不建议这样做。事实上,甚至在某些情况下,某些机构会通过逆向工程或在设备上使用第三方软件包,有这种可能性。而且我不认为如果你做出了一个替代软件包有什么法律上的问题。据我了解,在中国某厂运行的一台二手半导体设备软件包就是第三方制作的。如果真的能用,也没什么不合适的。

集微访谈:在二手设备的软件许可问题上,欧洲和美国看起来确实有一些法律法规的不同。

Stephen Howe:我认为欧盟目前正在尝试立法。根据他们之前的声明,其优先事项之一是努力保护环境。而且我认为中国也为保护环境做出了很多努力。因此,我们希望他们是认真的,他们可以帮助为我们提供更多立法,以确保供应链可以重复使用设备,因为这么搞其实并不一定触动原始设备制造商的最大利益。

例如我们可以看看ASML。他们在二手设备方面的处理方面非常成功,他们有一个专门的二手设备部门。这个部门在他们内部运行效率很高,因为整个公司对这个部门的支持力度很高。所有产品的性能、质量要比其他同行都做得很好。所以对此加以立法,设备和软件配套打包,不一定和这些OEM的利益相抵触。

集微访谈:目前很多全球头部的咨询机构,都会定时出台全球和区域性的半导体设备市场状况。我怀疑他们公布的这份数据其实是不包含二手半导体市场的。这个市场,在数据搜集以及各种信息披露方面,是不是到目前为止还是相对很不透明和碎片化的?

Stephen Howe:是的,完全正确。我完全同意你的观点。统计二手半导体设备市场是非常困难的,你可以说它是一个“秘密市场”,目前还是很分散的,这也使得这个市场变得非常有趣。

集微访谈:感谢您抽出时间接受我们的采访。

要购买二手设备,请访问我们的在线市场 www.fabsurplus.com